Fintech in Dubai & Abu...

Fintech in Dubai & Abu Dhabi

The fintech scene in the United Arab Emirates (UAE), particularly in Dubai and Abu Dhabi, is absolutely buzzing. Everyone's clamoring for a slice of this fast-growing pie. Why, you ask? The answer is simple: 'innovation and growth.' These magic words have drawn global players to the desert, all eager to tap into the vibrant opportunities this sector offers.

As fintech continues its global expansion, the UAE has emerged as a prime hotspot for fintech innovations. With its solid infrastructure and tech-savvy community, the UAE boasts a thriving ecosystem perfect for fintech app development. The e-commerce industry is on the rise, with more UAE consumers craving online payment solutions and merchants waking up to the power of an online presence. This upward trend shows no signs of slowing down, cementing the UAE’s status as a fintech leader.

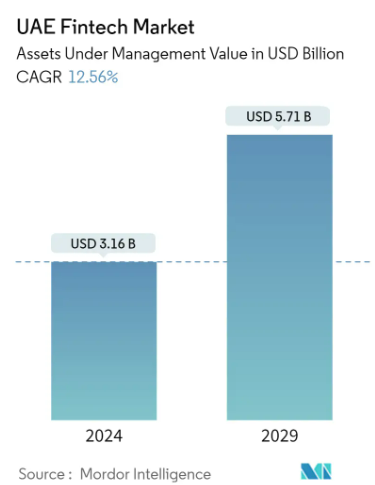

Here's a fun fact: The UAE fintech market's asset value is set to skyrocket from USD 3.16 billion in 2024 to a whopping USD 5.71 billion by 2029. That’s a cool compound annual growth rate (CAGR) of 12.56% during this period. The fintech future in the UAE is looking brighter than ever!

The surge in online shopping and digital payments has heightened the demand for secure and convenient payment solutions. This trend has prompted fintech firms to introduce innovative options like mobile wallets and touchless payments.

Recently, the United Arab Emirates has seen a rise in neobanks and the expansion of digital services by traditional banks. Neobanks aim to win over customers from traditional banks by providing similar products and services at more competitive prices. A supportive regulatory environment for fintech in the UAE has significantly contributed to the success and growth of neobanks.

Challenges and opportunities:

- Regulatory Harmonization: Making sure that regulations are consistent across the UAE can help fintech companies expand more easily.

- Talent Acquisition: Attracting and keeping skilled professionals in the fintech sector is crucial for growth.

- Cross-Border Collaboration: Partnerships between local and international fintech companies can drive innovation and open up new markets

Backend Developer

Back-End Development Course - Node.js, Databases, APIs

Turn your passion for coding into a lucrative web development career. Master PHP and Laravel to build dynamic, high-performance web applications, and gain insights into MySQL and other essential backend technologies.

Learn More

Training in PHP For Back-End Development

You Will Learn to:

Master PHP, MySQL, and Laravel to build powerful backend systems. By the course's end, you'll be ready to develop robust web applications.

Certified

Diploma

Certified

Diploma

Beginner

Level

Beginner

Level

8

Hours / Week

8

Hours / Week

AED 8,500

AED 8,500

Conclusion:

Dubai and Abu Dhabi are becoming hotspots for fintech innovation, thanks to supportive government policies, clear regulatory frameworks, and a dynamic startup ecosystem. As these cities continue to invest in technology and innovation, they are well on their way to becoming global leaders in fintech.

References:

Fintech in UAE Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029) | Mordor Intelligence (https://www.mordorintelligence.com/industry-reports/uae-fintech-market)

UAE is an ideal hub for fintech | Khaleej Times (https://www.khaleejtimes.com/business/uae-is-an-ideal-hub-for-fintech)

Home

Home